Connect your integrations

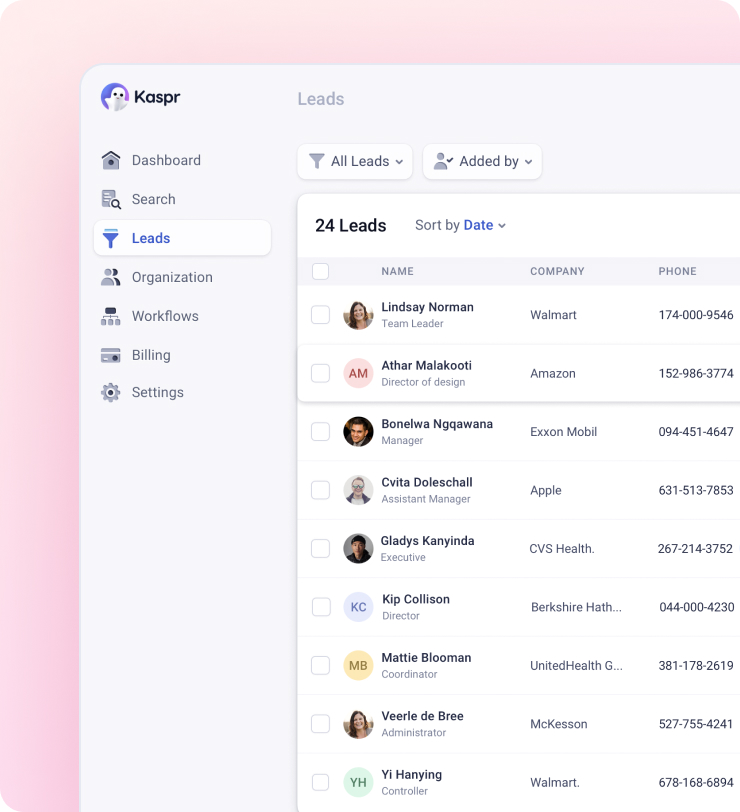

Manage everything via one platform. Your team, your clients, your leads, everything – Using just the Dashboard.

![]() Head Of Asset Management

Head Of Asset Management ![]() Temporis Capital

Temporis Capital

JOB TITLE

JOB TITLEHead Of Asset Management

COMPANY NAME

COMPANY NAMETemporis Capital

LOCATION

LOCATIONLondon, United Kingdom

EXPERIENCES

EXPERIENCESHead Of Asset Management

38 Berkeley Square; London, United Kingdom

38 Berkeley Square; London, United Kingdom

- Present

We are an investment management firm which specialises in the renewable energy and clean technology sectors across multiple asset classes. Our current assets under management are over $700m. Our team of over thirty investment professionals has combined experience of over 170 years in renewables and over 400 years in financial services. Since 2010, we have helped to create over 250 MW of renewable energy capacity. Business Focus Equity Infrastructure The Temporis Equity Infrastructure team manages a number of private and public renewable energy portfolios together totalling over 120MW in the UK and Republic of Ireland across onshore wind, hydro, biomass, solar, energy efficiency and landfill gas technologies. We typically engage with developers in the post-consent, pre-financing stage of a project on an equity only or project financed basis. The target project size is between 500kW and 20MW with a flexible investment approach covering joint ventures and outright acquisitions. We have a track record of delivering added value solutions to our investors and partners at every stage of the project life cycle. Direct Lending Temporis Capital provides long term project finance to the UK onshore renewable sector through its direct lending platform. Funding is provided for new projects, either in the construction or operations phase, as well as for refinancing existing projects or portfolios. The target market for loans is 500kW to 20MW, although consideration can also be given to projects outside those parameters. Listed Equities The modern world depends on food, energy and water. The world is facing crises in the availability of these vital natural resources. Temporis' investment philosophy is that the global economy is facing huge structural change across these fundamental sectors. These dislocations are creating excellent conditions for implementing an active investment strategy. Disruptive technology and government interference are creating uncertainty and volatility in global equity prices leading to undiscovered investment opportunities. Temporis' highly experienced listed equities team has a proven track record of delivering a responsible investment strategy, and works with clients who lack in-house expertise but are looking to gain exposure to these opportunities.

| FULL NAMES | JOB DESCRIPTION | COMPANY | LOCATION | PHONE NO. | ||

| Sebastian Watson | Head Of Asset Management | Temporis Capital | London, United Kingdom | s***@temporiscapital.com | +44 *** |

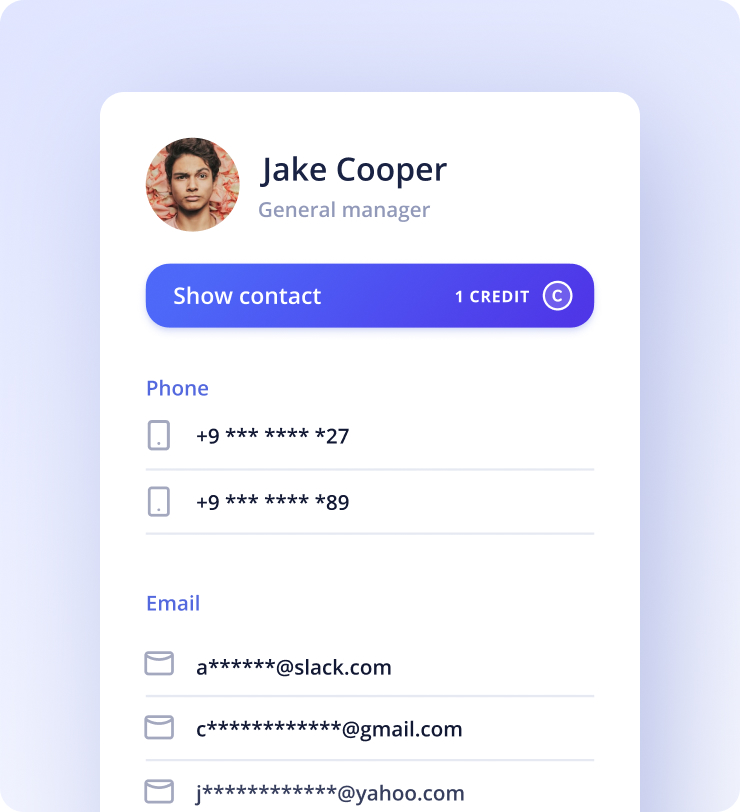

Kaspr will display your prospect’s contact information the moment you visit their LinkedIn profile. Quick! Isn’t it?

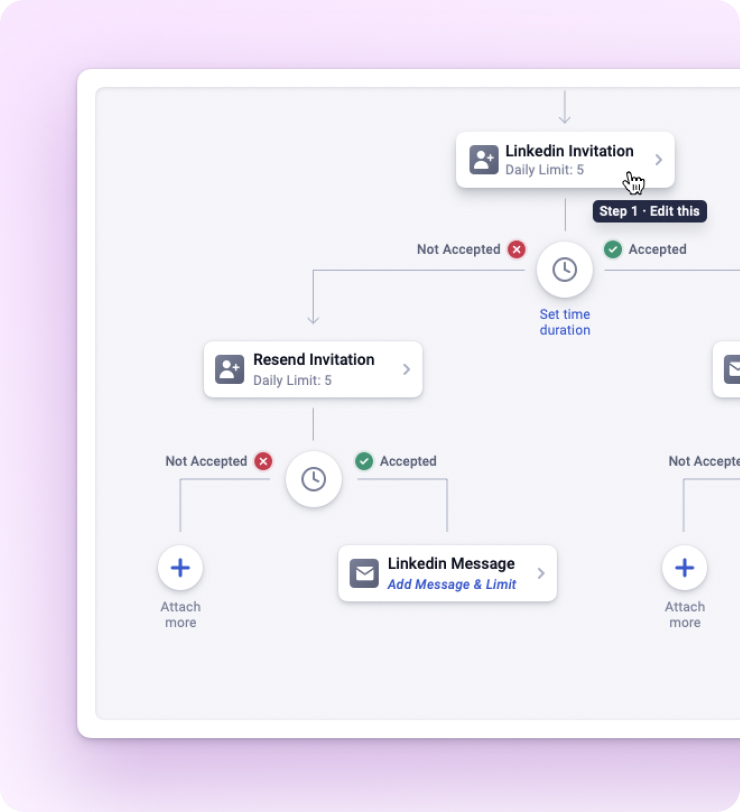

Kaspr lets you send automated follow up messages to your leads. Send them on your chosen day and time.

Manage everything via one platform. Your team, your clients, your leads, everything – Using just the Dashboard.